All Categories

Featured

Table of Contents

Below is a hypothetical comparison of historical performance of 401(K)/ S&P 500 and IUL. Allow's think Mr. SP and Mr. IUL both had $100,000 to conserved at the end of 1997. Mr. SP invested his 401(K) money in S&P 500 index funds, while Mr. IUL's cash was the money worth in his IUL policy.

IUL's plan is 0 and the cap is 12%. Because his money was saved in a life insurance policy, he doesn't need to pay tax obligation!

North American Builder Plus Iul 2

Life insurance coverage pays a death advantage to your beneficiaries if you ought to die while the policy is in effect. If your family members would encounter financial challenge in the occasion of your death, life insurance policy supplies peace of mind.

It's not one of one of the most profitable life insurance coverage investment strategies, yet it is one of one of the most protected. A type of permanent life insurance policy, global life insurance policy enables you to pick just how much of your premium approaches your death advantage and exactly how much enters into the policy to accumulate cash money value.

In addition, IULs allow insurance policy holders to secure financings against their policy's cash money value without being taxed as income, though unsettled balances may be subject to tax obligations and charges. The primary advantage of an IUL plan is its capacity for tax-deferred growth. This suggests that any type of incomes within the plan are not exhausted till they are taken out.

Alternatively, an IUL plan might not be one of the most appropriate savings prepare for some people, and a standard 401(k) might confirm to be extra advantageous. Indexed Universal Life Insurance Policy (IUL) plans use tax-deferred development possibility, security from market downturns, and survivor benefit for recipients. They allow insurance holders to earn passion based on the efficiency of a stock market index while protecting against losses.

Iul Vs 401(k): Which Is Better For Retirement Savings?

Employers may additionally supply matching payments, better increasing your retired life savings potential. With a conventional 401(k), you can decrease your taxed income for the year by contributing pre-tax dollars from your paycheck, while likewise profiting from tax-deferred growth and employer matching contributions.

Several companies additionally provide coordinating payments, successfully giving you complimentary cash towards your retired life strategy. Roth 401(k)s function in a similar way to their typical equivalents yet with one key distinction: tax obligations on payments are paid upfront as opposed to upon withdrawal during retired life years (aviva iul). This means that if you expect to be in a higher tax bracket throughout retired life, adding to a Roth account might save money on tax obligations over time contrasted with investing only via standard accounts (resource)

With reduced management fees generally contrasted to IULs, these kinds of accounts allow capitalists to conserve cash over the long-term while still taking advantage of tax-deferred growth capacity. Additionally, many popular low-priced index funds are offered within these account kinds. Taking distributions before reaching age 59 from either an IUL policy's cash money value by means of lendings or withdrawals from a traditional 401(k) strategy can cause adverse tax ramifications if not dealt with very carefully: While obtaining against your policy's cash money value is usually thought about tax-free up to the amount paid in costs, any kind of overdue loan balance at the time of death or plan abandonment might be subject to earnings taxes and fines.

Indexed Universal Life (Iul) Vs. 401(k): An In-depth Retirement Comparison

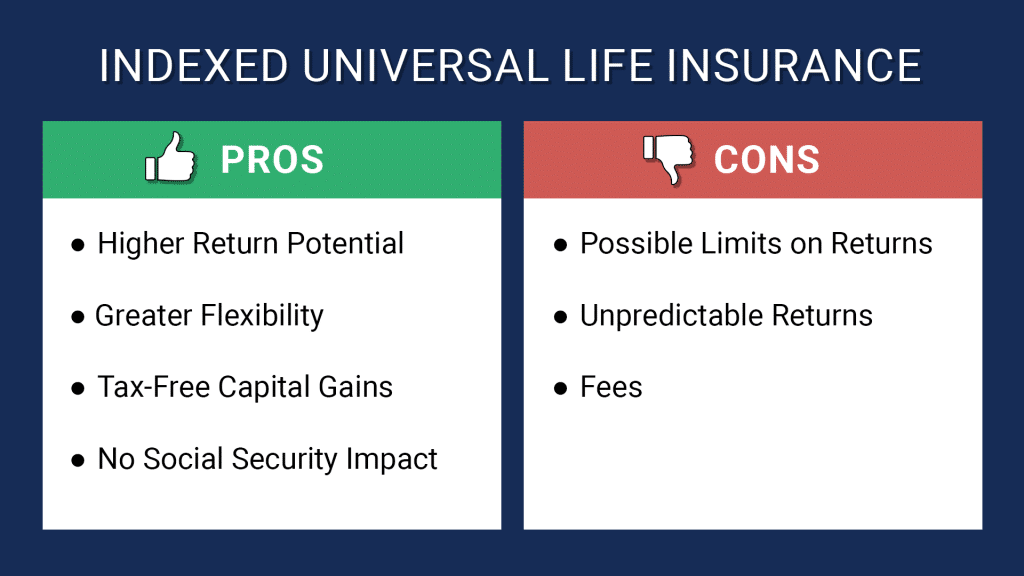

A 401(k) supplies pre-tax investments, employer matching contributions, and possibly more investment selections. Roth IRA vs IUL: Which Is Better for Tax-Free Growth?. Talk to a financial planner to identify the best alternative for your circumstance. The downsides of an IUL consist of greater management prices contrasted to typical pension, limitations in financial investment options due to plan limitations, and prospective caps on returns throughout strong market performances.

While IUL insurance policy may confirm useful to some, it's vital to comprehend exactly how it works prior to purchasing a plan. Indexed global life (IUL) insurance coverage plans supply greater upside possible, versatility, and tax-free gains.

firms by market capitalization. As the index relocates up or down, so does the rate of return on the cash value component of your policy. The insurer that releases the policy may supply a minimum surefire rate of return. There may likewise be an upper restriction or rate cap on returns.

Monetary professionals commonly recommend having life insurance policy coverage that's comparable to 10 to 15 times your yearly earnings. There are a number of disadvantages linked with IUL insurance coverage plans that critics fast to explain. Someone who establishes the policy over a time when the market is performing improperly could finish up with high premium payments that don't contribute at all to the cash money value.

In addition to that, remember the following other factors to consider: Insurer can establish engagement prices for just how much of the index return you obtain yearly. Let's claim the plan has a 70% participation price. If the index grows by 10%, your cash money worth return would certainly be just 7% (10% x 70%)

In addition, returns on equity indexes are often covered at a maximum amount. A policy could say your optimum return is 10% each year, regardless of just how well the index carries out. These limitations can restrict the real rate of return that's credited towards your account each year, no matter exactly how well the plan's underlying index carries out.

Top Iul Companies

IUL plans, on the various other hand, offer returns based on an index and have variable costs over time.

There are lots of other kinds of life insurance policy policies, discussed below. supplies a set benefit if the insurance policy holder dies within a collection period of time, normally between 10 and 30 years. This is one of one of the most economical sorts of life insurance policy, as well as the most basic, though there's no cash worth buildup.

What Is The Difference Between Indexed Universal Life (Iul) And 401(k)?

The policy acquires worth according to a fixed routine, and there are less charges than an IUL policy. A variable policy's cash value might depend on the performance of specific supplies or other safety and securities, and your costs can likewise alter.

Latest Posts

Universal Life Insurance Loans

Universal Life Insurance Calculator Cash Value

North American Universal Life Insurance